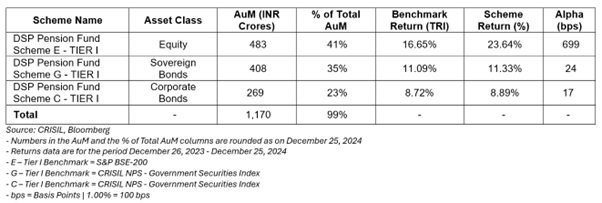

We, at DSP Pension Fund, began our operation on 26th December 2023. On 1st January 2024, we invested your first rupee across our schemes. From Rs.0 to ~Rs.1,200 Crores of AuM (Assets Under Management), our first year was both exciting and challenging - from helping our investors understand our value proposition to managing our growing AuM effectively across our 8 schemes - as equity and bond markets rallied. In this update, however, we are primarily going to focus on 3 of our Tier I schemes that comprise ~99% of our subscribers’ capital managed by us.

Getting surprises out of the way, here is our fund performance:

Equity Schemes

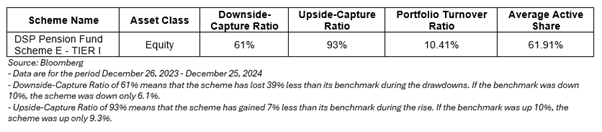

We implied in our half yearly update that we are fine with the underperformance if it is an alternative to taking undue risk. We stand by this dictum.

Equities are inherently volatile and risky. We prioritize resilience over optimization, focusing on minimizing risk across all asset classes, particularly equities.

Avoiding significant losses is a pre-requisite to endure and prosper over the long haul. Losses in equities typically stem from three key missteps: 1) investing in businesses with fragile models or excessive leverage, 2) paying prices that defy reason, and 3) trusting companies with shaky corporate governance. The truth is - the number of businesses that meet our criteria is always small, regardless of market conditions. Our job is to understand such companies and invest in them only when the price tag offers a margin of safety - a compelling balance between risk and reward.

Our equity schemes continue to stand out with high Active Share, sometimes reaching ~70%. With the number of holdings at 27, we remain well diversified but continue to maintain a relatively low number of holdings in our portfolio. Among all the other 11 pension funds in the country, our portfolio not only boasts the highest Active Share and the fewest stocks but also continues to maintain the highest average allocation to cash that at times nearly reached the maximum allowed 10%.

Why we did what we did

Below, we share glimpses of our simple thought process behind few of our portfolio decisions.

HDFC Bank

In January 2024, HDFC Bank faced a tough quarter, with its stock plunging over 15% in just a week. Over the preceding five years, the stock had stagnated, despite the bank consistently delivering earnings growth and a robust RoE (return on equity) above 15%. This marked a critical shift: the market had reclassified HDFC Bank from a high-growth stock to a value play.

Before its merger with HDFC Limited, the bank’s market capitalization stood at approximately ₹10 lakh crore, while the parent company was valued at ₹6 lakh crore. Post-merger, however, the combined entity’s market cap contracted to around ₹10 lakh crore. While both entities had been effectively managing their operations independently, the valuation haircut reflected lingering market concerns about growth prospects. In our assessment, these concerns were justified to some extent. However, we believed the valuation impact of the merger had been overly discounted and the overhang was largely being resolved.

Trading at approximately 16x earnings - compared with the S&P BSE-200’s ~22x - the stock presented an attractive risk-reward opportunity. HDFC Bank’s prudent lending practices, granular loan book, and consistent deposit growth distinguish it not only from its peers but also from the average company in the indices. We believed market expectations had been set far too low, and the stock price offered a compelling margin of safety. Confident in this assessment, we decisively made HDFC Bank our largest position and continue to maintain that conviction.

Kotak Mahindra Bank

Kotak Mahindra Bank's prudent lending practices, while mitigating risks, have inevitably tempered its growth trajectory. Coupled with a premium starting valuation in recent years and succession planning uncertainties, this slower growth has weighed on the stock price, which now reflects a limited growth outlook. However, the market seems to overlook the long-term advantages of Kotak's conservative approach that leads to one of the lowest NPAs (non-performing assets) among large banks and strong governance.

While HDFC Bank's aggressive expansion strategy may offer countercyclical benefits, Kotak's steady and sustainable growth model also positions it as a compelling long-term investment. The recent regulatory hurdles including the RBI’s embargo have not diminished our confidence in Kotak, especially given its attractive valuation relative to that prevailing in the broader market.

ITC

Smoking is often criticized as illogical, damaging both health and wealth. Yet, as Rory Sutherland writes in his book Alchemy - that human behavior is rarely purely logical - it is deeply psychological. These insights reflect why people continue to smoke and why ITC, India’s cigarette monopoly with ~75-80% market share, remains a dominant force. ITC’s competitive advantages are undeniable:

- Lindy Effect: Tobacco’s endurance as a product is unmatched. Despite heavy regulation, it has thrived for centuries. ITC itself has operated for over 111 years, a testament to its durability.

- Regulatory Capture: Obtaining a tobacco license in India is an arduous process, with stringent restrictions and significant taxation. ITC’s decades-long mastery of this landscape gives it an unassailable edge.

- COTPA, 2003: Advertising bans on tobacco make it nearly impossible for new entrants to build scale. ITC’s regulatory expertise and established market presence are unparalleled.

- Mindshare: ITC’s cigarette brands, like Gold Flake and Classic, enjoy deep customer loyalty built over decades, making it nearly impossible for competitors to gain ground.

While the combination of these advantages makes the moat timeless, the stock’s underperformance from 2013 to 2019 stemmed from declining RoIC (return on invested capital), driven by investments in its low-margin hotel business and capex in FMCG business combined with exceptional starting valuations for a company that is reasonably mature. However, post-Covid, the company has achieved a robust ~16% EPS CAGR (compounded annual growth rate) over the last three years, surpassing expectations for a business with over 40% RoIC. While the stock price of ~26x trailing earnings isn’t cheap for a business growing profit in single digit, it offers steady long-term upside. ITC’s enduring moat and diversified, resilient business model makes it a compelling portfolio holding, with opportunities to add over time.

Bajaj Holdings & Investment

Since January 2024, Bajaj Holdings has been a compelling opportunity. It's been trading at a significant discount to its intrinsic value, essentially meaning you can buy a dollar of assets for less than a dollar – sometimes less than a half.

At the heart of this holding company are two powerful businesses: Bajaj Auto and Bajaj Finserv. Together, they make up the lion's share of its value. Bajaj Auto, a renowned name in the two-wheeler industry, is experiencing a resurgence. And Bajaj Finserv, with its array of financial services businesses, is undervalued.

The folks running this show have a proven track record of smart capital allocation. They've consistently grown the business and delivered value to shareholders.

While the discount has narrowed a bit, we're still optimistic about the long-term prospects. Even if the discount doesn't fully disappear, the underlying value of the holdings should continue to appreciate over time.

Mahindra & Mahindra

Mahindra & Mahindra (M&M) operates across three key segments:

- Automotive: A leader in SUVs with a 21% revenue market share, M&M offers popular models like the XUV 300, XUV 700, Thar, Bolero, and Scorpio-N. It is India's second-largest Commercial Vehicle (CV) company, the largest Small CV (<3.5T) player, and the top CV exporter, with brands like Bolero Pik-up, Blazo, and Supro.

- Farm Equipment: Dominating India's tractor industry for 40 consecutive years, M&M’s major brands include Swaraj, Trakstar, Erkunt, and Sampo. It has a strong global presence, operating in 4 of the 5 largest farm equipment markets worldwide.

- Subsidiaries & Investments: M&M holds significant stakes in subsidiaries such as M&M Financial Services, Mahindra Lifespaces, and Swaraj Engines, and a 25% stake in Tech Mahindra. Additionally, it has a niche presence in two-wheelers with the Jawa brand.

We believed that M&M could trade at ~11x EV/EBITDA on the core business. Adjusted for subsidiaries, the market value of ~7.5x FY26 EV/EBITDA vs that of peers at 12-18x was attractive at the time. Like Bajaj Holdings, M&M continues be debt free.

Valuing listed and unlisted subsidiaries at appropriate holding discounts in our judgement, we valued M&M much higher than the market price, based on sum-of-the-parts (SoTP). We had built a large position that has come down as the stock price rallied and our fund size grew.

Coromandel International

We do not currently hold Coromandel International, as it moved out of the S&P BSE-200, which is our mandated coverage universe by NPS Trust and PFRDA – institutions that regulate pension funds in India. However, Coromandel was one of the important contributors to our performance during the year. We are choosing to explain our position because of our large allocation to it as we began our pension fund’s operations.

Coromandel International operates in two key segments: Nutrient and Allied Products, which contribute around 85% of its revenues, and Crop Protection (CPC), accounting for the remaining 15%. The company has a strong retail presence with more than 700 centers across the states of South India. These centers offer a diverse range of products, including nutrients, pesticides, seeds, veterinary feed, and farm implements. Coromandel also boasts a robust product pipeline, focusing on innovations such as plant extract compounds and microbial bio-pesticides.

Until 2017, Coromandel maintained a strong RoE of ~22%, which has since improved to more than 25% due to consistent asset turnover and strategic measures like raw material outsourcing and investments in ventures like Tunisian Indian Fertilizers S.A. It has successfully transitioned to being debt-free through its free cash flow.

While rising input costs impacted margins, the company’s talented and trustworthy management expected normalization. At the beginning of CY24, Coromandel traded at 15x TTM and 13x FY24E earnings, with projected earnings growth of ~12% CAGR over the next 3-4 years. We believed that the stock was undervalued, presenting significant upside potential.

Cash

Cash is trash has been one of the most disingenuous statements that even several seasoned professionals continue to make. This perspective overlooks the flexibility cash provides to a portfolio manager during significant market drawdowns, enabling timely deployment into securities with favorable risk/reward dynamics.

For instance, on June 04, 2024, when the S&P BSE-200 plunged 6.76%, cash not only shielded us from losses but also empowered us to act decisively and seize opportunities. One of our portfolio holdings was down 26% for the day, yet we ended the day, outperforming our benchmark by 203 basis points (2.03%).

It is normal for markets to fluctuate wildly and fall on random days. Over time, losing less during drawdowns could be a reasonable edge. While holding cash is never our objective, it serves as our default position in the absence of compelling investments.

Ultimately, trusting a fund manager means believing in their ability to deploy cash wisely at the right prices. If that trust is absent, investing with them may not be the right choice.

Government Securities Schemes

Our Fixed Income schemes are managed by Deepak Chahar, who has demonstrated the ability to think different from the consensus. It is especially more difficult in the Fixed Income space than in equities because of the onerous amounts of noise around global and local macro-economic indicators. Something unexpected somewhere in the world can always topple one’s approach.

Among the 11 pension fund managers in India, we held the highest Modified Duration at approximately 11 years throughout the year. This reflects our conviction that Indian government bond yields will decline over time. By comparison, our benchmark’s duration has been around 8.5 years. A longer portfolio duration means greater sensitivity to interest rate changes, and this deliberate deviation underscores our active, independent approach to managing portfolios and risk.

Yet, we know we need to be nimble and agile. We can’t just stick to “our view” when it makes sense to take a different one. Indian & US central elections, inflationary pressures and geopolitical uncertainties – raised some challenges to manage fixed-income investments. In response to these challenges, we reduced the duration of our portfolio to mitigate the negative impact of rising yields. This tactical approach allowed us to effectively manage risk during volatile market conditions.

Just as equities fell swiftly and sharply after the election results, the yields on the 10-year benchmark G-Sec simultaneously surged from 6.95% to 7.03%. We had ~8% of our portfolio in cash. As it did for our equity schemes, this cash position not only protected us from the notional and somewhat real losses associated with the rise in yields but also positioned us to act decisively. Despite the liquidity issues we faced because of our small AuM, as we began our operations, the cash in our portfolio allowed us to seize some opportunities, contributing to our outperformance. While our focus has been and will always be capital conservation first and performance the second, I would like to point out that our Scheme G – Tier I outperformed its benchmark and every other pension fund in the country, during the year.

Corporate Bond Schemes

Our focus has been on investing in NCDs (Non-Convertible Debentures) issued by high-quality PSUs, Banks, Corporates & NBFCs with robust corporate governance practices, ensuring a solid foundation for sustained growth. While we analyze each company’s books without outsourcing our thinking to the credit rating agencies, we want to point out that we have ~98% of our AuM of Scheme C – Tier I in AAA rated securities and only ~2% in AA+ rated securities. Again, capital conservation is most important to us than earning a few basis points higher than our peers or benchmark. Our investment philosophy across asset classes is built on the long-term view - investing is a marathon, not a sprint.

The biggest challenge for us as a new pension fund was our small size to negotiate better deals and our limited ability to deal in Market Lots. As our AuM grows in the coming years, we will probably be able to move out of dealing primarily in Odd Lots and negotiate better yields. Scheme C – Tier I performed in line with our expectations, outperforming our benchmark but underperforming all our peers who deal primarily in Market Lots at better yields.

The Way Forward

The Tier I lock-in period under the National Pension System does more than just secure your savings - it also protects you from the pitfalls of impulsive, short-term decision-making. For us, it provides the stability to focus on managing your investments with a long-term horizon, which is where real wealth is built.

We will continue to actively manage our schemes with discipline and care. Across all portfolios, we maintain reasonable cash reserves, ready to deploy swiftly when exceptional opportunities arise - those with compelling risk-reward dynamics that align with our investment framework. Balancing caution with decisiveness, we aim to create lasting value through market cycles.

A word of caution: outperforming a benchmark one year sets a high bar for the next, and consistent outperformance becomes progressively challenging. We encourage you to temper your expectations, as our focus remains on steady, thoughtful growth rather than chasing unsustainable returns.

Here, you can read our Framework and Process for Portfolio Management and go through our Schemes’ Factsheets.

Disclaimer

Investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implications or consequences of subscribing to the schemes of DSP Pension Fund Managers Private Limited. Tax laws are subject to change.

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. Returns under NPS are subject to market risk and are prone to fluctuation depending on the state of the financial market.