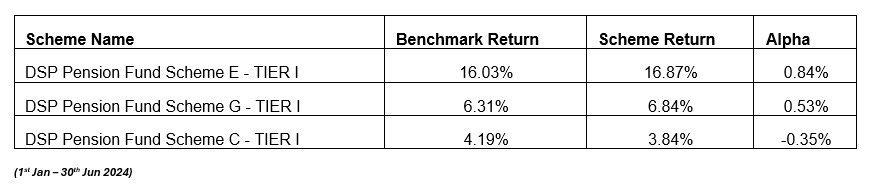

Since 1st January 2024, as we at DSP Pension Fund invested our first Rupee across our Government Securities, Corporate Bonds and Equity Schemes, we have been very clear that we are going to manage our unitholders’ capital for the long haul. Not succumbing to short term pressures due to inevitable underperformance at various points in time, our objective is to perform better than our benchmarks. If we do not do so in the long term, we believe that there is no reason for our existence as an active manager. We do not chase outperformance but firmly believe that Alpha is a byproduct of a sound investing process and judgment.

Managing Fixed Income portfolios, we avoid reaching for yields. While there is not much that one can infer from such a short period of performance, our GTI Scheme that has the highest AUM among our Fixed Income schemes was ranked 1 out of the 11 pension funds. Deepak Chahar, our Fixed Income Fund Manager, has done a tremendous job managing these schemes responsibly despite facing issues related to Odd Lots and Liquidity, as we have been growing from a small base. Deepak thinks independently and long term, and my job is to let him do his thing.

Managing equities, we avoid chasing high prices. It remains fascinating to us how the inefficiencies in one part of the market disappear over time to only appear in another. We do not only want to protect our unitholders’ capital with utmost caution but also grow it with competence, rigor and conservative aggression. We want to be patient, wait for attractive risk/reward opportunities to appear during normal market gyrations and act aggressively when they do.

Among 11 pension funds in India, our equity schemes stand out with the highest Active Share, sometimes reaching ~70%. In contrast, most of our peers hover around half of that mark. We maintain the lowest number of holdings at 29, whereas the next lowest in the industry holds nearly double that number. Furthermore, our portfolio not only boasts the highest Active Share and the fewest stocks, but also has the highest average allocation to cash, sometimes reaching the maximum allowed 10%.

We consider cash a call option against market volatility and insurance against our own ignorance and mistakes. Cash gives us capacity to suffer and makes us somewhat Antifragile. Anything can happen on a random day, but when our benchmark, S&P BSE-200 fell 6.76% (the largest drawdown in the past 3 years on a single day) on 4th June after the day of the Exit Polls, our ETI Scheme fell 4.73%, giving us a considerable lead against our peers. We believe that falling less than an average stock during inevitable market drawdowns is a hallmark of a fundamentally strong portfolio. We may rank 1/11 or 11/11 over any given timeframe, but we would stay the course, relentlessly executing our investment strategy based on first principles. So far, we haven’t, but we are fine to underperform rather than risk our unitholders’ capital during the raging bull markets that we are currently experiencing.

“You are so aggressive. You are taking high risk, running high active share and deviating too much from the benchmark. If markets fall, you will be crushed.”

“You are so conservative. You are taking too much risk by keeping such a high cash position in the funds. It must hurt during the current uptrend.”

We field these arguments daily. These arguments keep us paranoid. Remember Andy Grove? The flaw in these arguments is that they are made in isolation. Not many have understood our portfolios’ nuances and positioning to be short term cautious and long term aggressive all the time. “You have high Active Share, so it makes sense to keep high cash.” An average market participant thinks Black or White whereas great investors think Black and White. We do not consider ourselves great investors. However, we read the greats and stand on their shoulders, wobbling to see farther. We want to back our convictions, but we do not want to be fragile.

The only risk we consider while managing our portfolios is the risk of permanent loss of capital. That risk arises while buying bad companies and paying unsustainably high prices. To us, resilience of our schemes and portfolios is more important than optimization. We try to evolve and get better, but we do not believe we can fully optimize our execution, even if we’re able to fully optimize our processes. We stick to what works in markets over the long term – paying a lower price for a business than what it is worth and not partnering with people who lack talent and integrity.

Here, you can read our Framework and Process for Portfolio Management and go through our Schemes’ Factsheets.