Do You Track Your NPS Portfolio Fund Performance and Evaluate Your Fund Manager

When it comes to planning for retirement, you have done the right thing by investing in NPS now it is also important to track how your NPS portfolio is performing. Tracking the performance of your NPS fund portfolio is a big deal. Why? Well, it directly affects how much you’ll have saved up when it’s time to kick back and relax. A well-performing fund can boost your retirement corpus, which means a healthier monthly pension for you. Plus, keeping an eye on your funds helps you adjust your asset allocation to hit those retirement goals. You might find yourself needing to tweak your exposure to equity or debt funds based on how they’re performing.

So, How Do You Evaluate a Fund Manager?

Let’s dive into what you need to consider when checking out your fund manager:

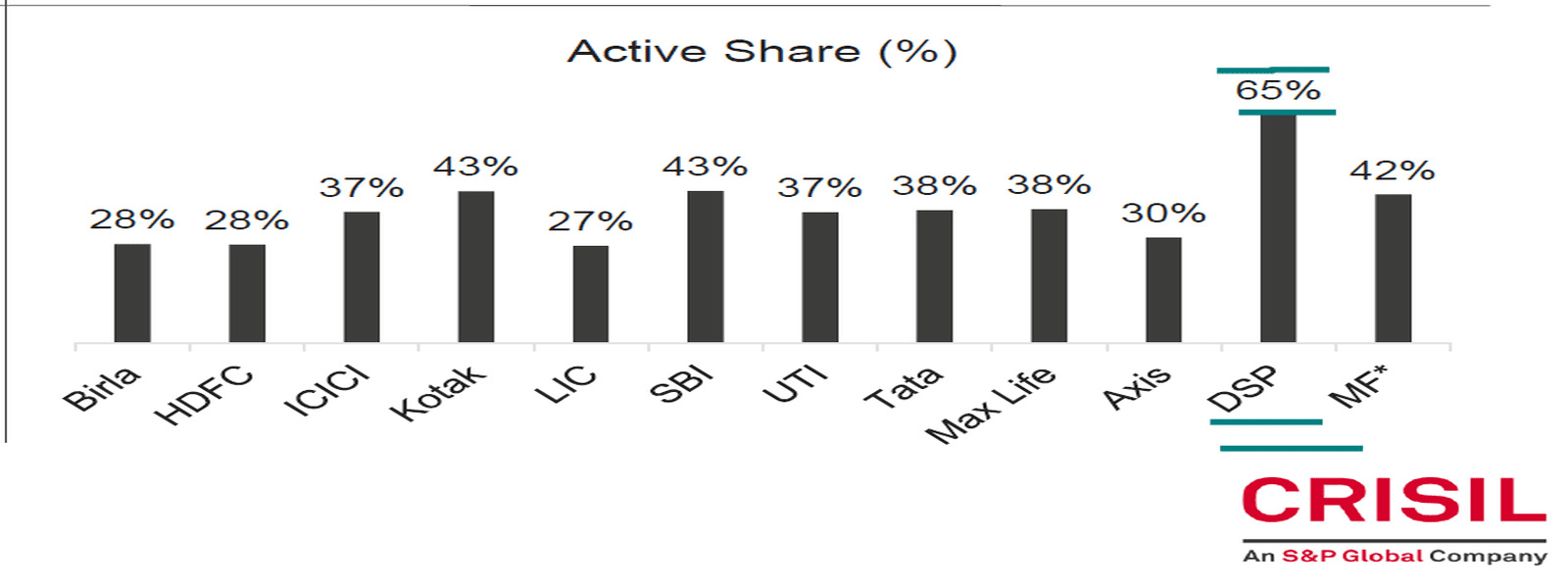

1. Active vs. Passive Management:

First up, is your fund manager actively managing your investments or just playing it safe and mirroring an index? If they’re just copying the BSE 200, that’s a red flag. Passive managers are kind of like those students who only aim to score just enough to pass. Active managers, on the other hand, should be taking calculated risks to outperform the benchmark. They’ll have a portfolio that looks different from the index, making smart moves on stocks they believe in.

Active Share%

Source: Performance evaluation of NPS Pension Fund Managers

Report by Crisil

2. Risky Business?:

Next, let’s talk risk. Is your fund manager diving into companies with huge debts or heavy losses? A savvy manager will avoid these risky bets. They should focus on solid companies with good fundamentals and manageable debt. If your manager is piling into high-risk investments, it might be time to rethink that strategy. Check their portfolio, every pension fund manager(PFM) has to publish the portfolio on their website. Here is ours Latest Portfolio & Factsheet

3. Portfolio Size:

Another thing to look at is the size of the portfolio. A smaller portfolio can often mean a more focused and confident approach. If a fund manager is spreading their investments too thin across too many stocks, it might lead to average returns. A well-curated portfolio indicates that they’ve done their homework and are backing companies they truly believe in.

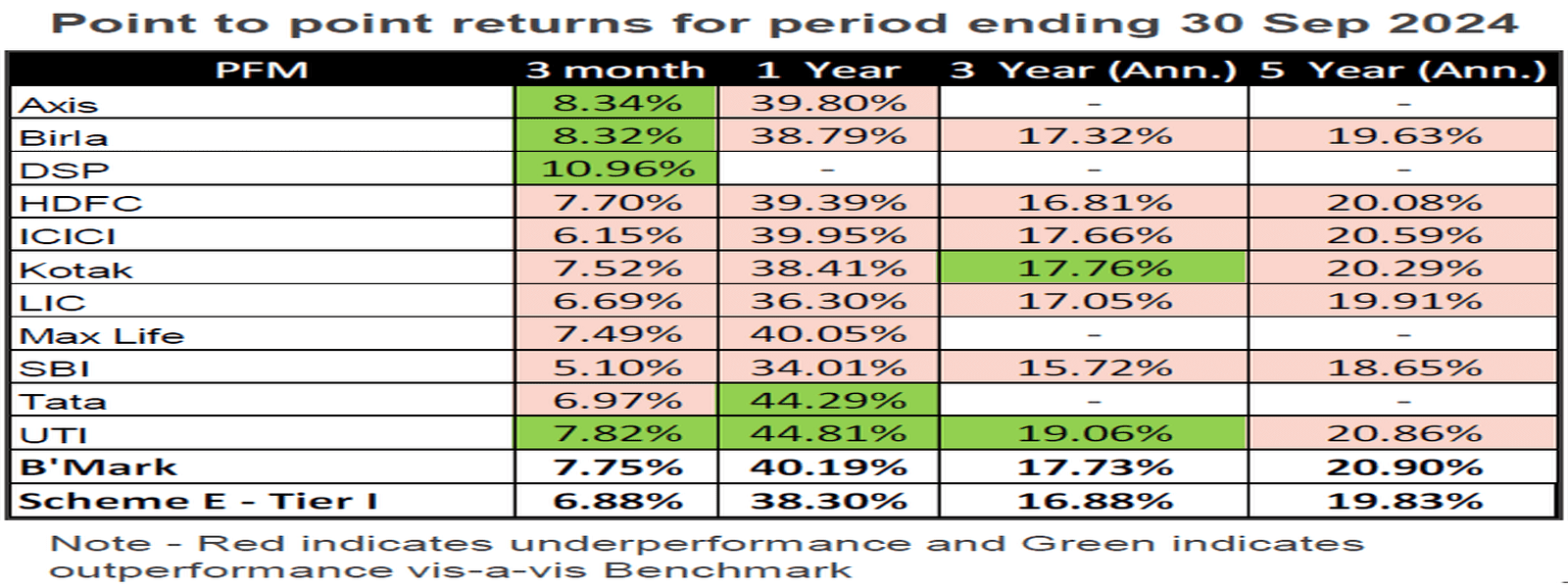

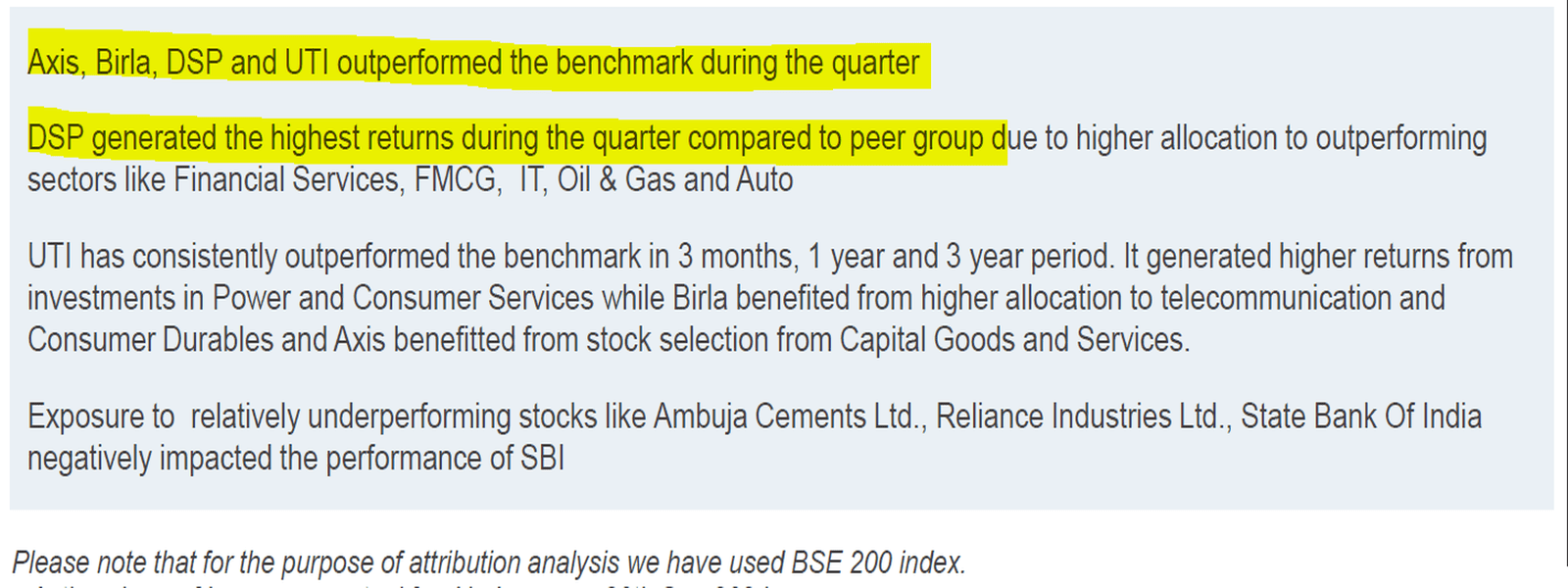

4. Benchmark Performance:

Finally, you want to see if your fund manager has been able to beat the benchmark. If they’ve been lagging for a while, it could be time to explore other options. Thankfully, switching fund managers isn’t as complicated as it sounds—you can usually do it right through your CRA’s website or an app. Here is glimpse of fund performance by DSP Pension against benchmark (BSE 200 Index)

Fund Performance

Source: Performance evaluation of NPS Pension Fund Managers

Report by Crisil

Benchmark Returns

Source: Performance evaluation of NPS Pension Fund Managers

Report by Crisil

At DSP Pension, we take transparency seriously. That’s why we’ve rolled out detailed fact sheets—an industry first in the pension space—so you can see all the nitty-gritty of our portfolio. Check out our fund performance compared to benchmarks here.

Wrapping It Up

So, to sum it up: keeping tabs on fund performance and evaluating your fund manager is super important for a secure retirement. By staying informed, you can make smart adjustments to your investment strategy, ensuring you’re on the right track for a comfortable future. Your retirement is in your hands—make sure you’re giving it the attention it deserves!

Disclaimer:

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. Returns under NPS are subject to market risk and are prone to fluctuation depending on the state of the Financial market.

Investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to the schemes of DSP Pension Fund Managers Private Limited. Tax laws are subject to change.