The National Pension System (NPS) operates within a decentralized ecosystem (open architecture), designed and monitored by the Pension Fund Regulatory and Development Authority (PFRDA). At the core of this structure lies the NPS Trust, which supervises and monitors all key agencies involved in the system, ensuring accountability and performance. NPS is a robust framework designed to help individuals effectively plan for retirement through systematic and regulated savings. NPS ensures the efficient operation of pension funds and offers a transparent platform for contributors.

Key Components of NPS Architecture

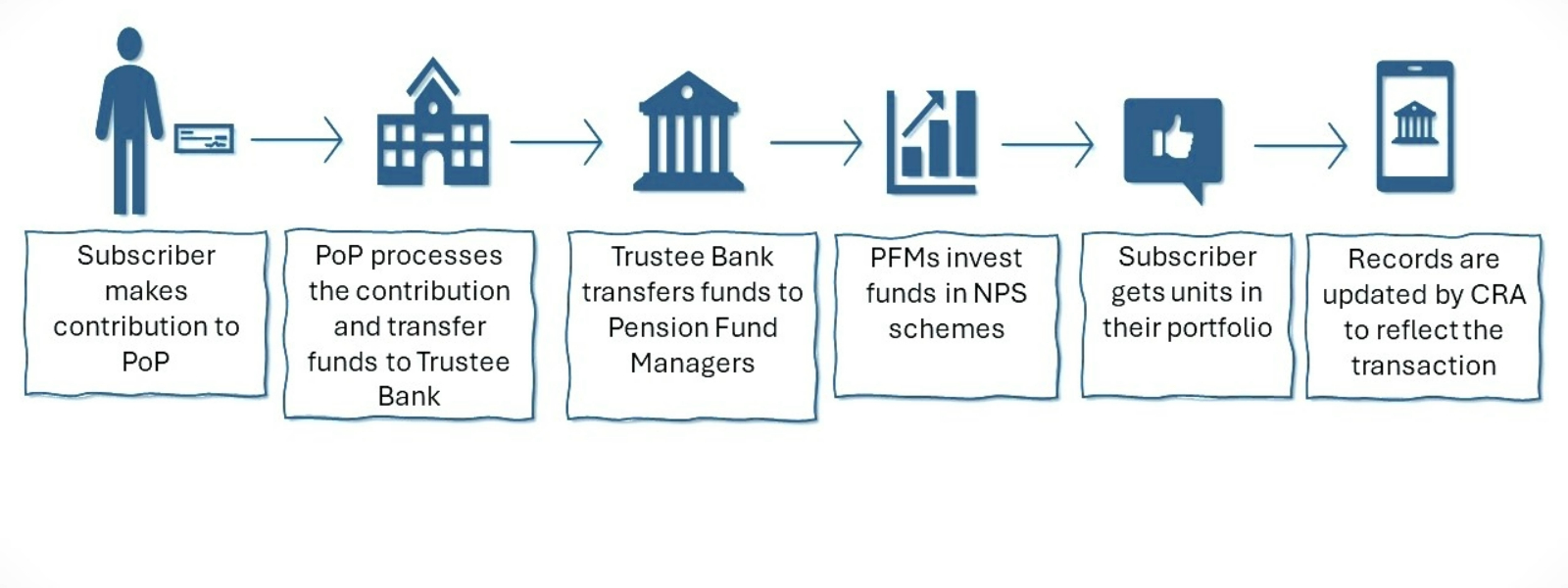

The NPS ecosystem consists of several essential players, each contributing to the smooth functioning of the system:

Points of Presence (PoPs)

PoPs serve as the initial access points for subscribers, providing crucial services related to opening and maintaining NPS accounts. They encompass various financial institutions, banks, and other entities, simplifying the process of enrolling and contributing to NPS. PoPs handle contributions, manage KYC (Know Your Customer) processes, and offer customer support. To open your NPS account you can click on the link here.

Pension Fund Managers (PFMs)

PFRDA has appointed 11 Pension Fund Managers responsible for managing the pension contributions of subscribers. These PFMs invest accumulated funds across diverse asset classes, including equity, government securities, and corporate bonds. Their primary objective is to generate returns on contributions while balancing risk and growth, ultimately providing long-term benefits to subscribers. DSP Pension is one of the PFMs appointed by PFRDA (our Investment Framework).

Central Recordkeeping Agencies (CRAs)

The PFRDA has designated three CRAs to maintain the records of all NPS subscribers i.e. Protean, Kfintech, and CAMS. These agencies play a vital role in administering NPS accounts, processing contributions and withdrawals, issuing account statements, and delivering customer service. CRAs ensure transparency in managing subscriber data, further enhancing the integrity of the NPS framework

Custodian and Trustee Bank

In addition to these core components, two critical entities enhance the security and efficiency of NPS:

• Custodian: Deutsche Bank acts as the custodian, safeguarding the securities and assets purchased by Pension Fund Managers on behalf of subscribers. This role is vital for ensuring the proper handling and security of investments.

• Trustee Bank: Axis Bank functions as the Trustee Bank, managing banking operations related to NPS. This includes receiving pension contributions, overseeing fund transfers, and disbursing funds to the respective Pension Fund Managers.

The interconnected architecture of the NPS ensures that funds are managed efficiently and securely, allowing subscribers to benefit from competitive returns. By understanding how these components work together, individuals can make informed decisions about their retirement planning, securing a sustainable source of income post-retirement. Whether you are just starting to save or are nearing retirement, the NPS framework provides a structured and reliable way to prepare for your financial future.

Disclaimer:

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. Returns under NPS are subject to market risk and are prone to fluctuation depending on the state of the Financial market.

Investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to the schemes of DSP Pension Fund Managers Private Limited. Tax laws are subject to change.

Written by

Other Blogs

Sort by